Help Flattening the Curve, Stay Calm and Carry On

Written by Jos Schmitt, President & CEO

Over the last two weeks at NEO, we have been focused on two priorities. First and foremost, protecting the health and well-being of our teams and our community at large. Secondly, maintaining our essential service in support of the Canadian capital markets.

Since March 13th, the vast majority of our team has been working from home. A very small core team remains in the office to ensure optimal responsiveness in the case of incidents and/or market developments that require immediate and decisive action. This team is shadowed by a second team, working from home, that can assume control of all activities if and when needed. The shadow team is both leveraging new technologies and performing drills, aiming to achieve the same level of responsiveness as the team in the office. Once we are confident we can achieve optimal remote responsiveness, our entire team will work from home. Until that time, we have implemented a number of enhanced health and sanitization practices to keep our team safe and limit the spread of infection.

COVID-19 is endangering and taking lives across the globe. The fight to contain it is having a real impact on our economies and financial markets, while also throwing a curve ball at all the business continuity processes we designed in the past. Lots of lessons to be learned to make us collectively more resilient in the future…

In addition to this brief update on NEO and our razor-sharp focus over the last couple of weeks, I would also like to use this opportunity to address a number of important questions that I have been asked repeatedly.

Are the measures taken by governments and public health authorities to address the COVID-19 health crisis an overreaction?

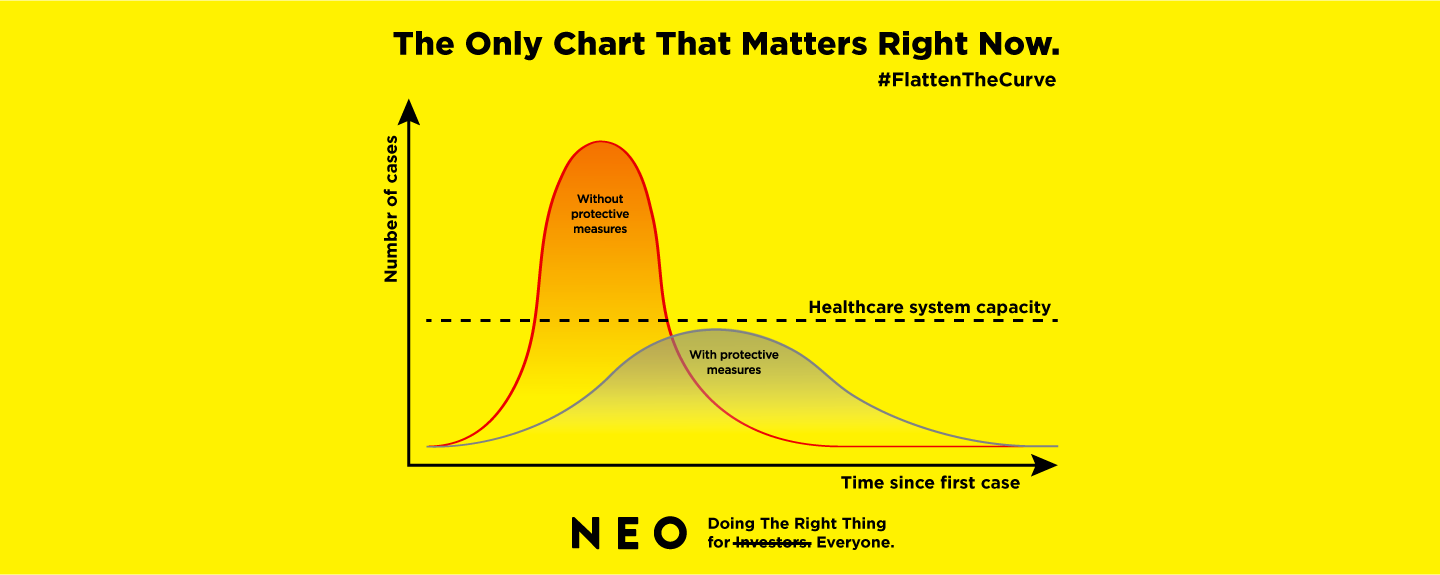

There should be no doubt in anyone’s mind that we are facing a global pandemic – a crisis of unprecedented proportions – that is putting many lives at risk. The measures imposed upon us, including social distancing, self-isolation, shutting down non-essential businesses, shelter-in-place orders, and lockdowns, are not about preventing or curing the COVID-19 disease. They are about slowing down the rate of infection and containing the spread. This will allow our health care systems, which have a finite capacity, to care for the severe and life-threatening COVID-19 cases while not abandoning other healthcare urgencies. The aim is also to have the number of people recovering outpace the number of people becoming infected, thus building up a barrier of immune people around the vulnerable and elderly. This is what the #FlattenTheCurve diagram is all about.

Let’s all work on flattening the curve – or indeed, planking the curve – by following guidelines and instructions and spreading the word. We plan to use our social media channels and other platforms to continue sharing this message. The little steps matter and doing the right thing really makes a difference. It saves lives!

Should the markets be closed until things calm down?

I read and hear this question a lot, typically posed by parties who don’t have a clear understanding of the purpose of markets and why they are important.

Markets absorb information and translate that information into the pricing of assets, whether they are corporations, bonds, or any other type of financial instrument. They are the barometer of our companies and our economies, and they give us a view on what we can expect in the foreseeable future. Without the markets, we drive blind and have no insight on whether financial interventions by governments, central banks, or other supranationals are meaningful and addressing the issues. Without the markets, we have no benchmark against which we can evaluate new investment opportunities or transactions that could be beneficial to our companies, our economy and ultimately employment.

The markets are extremely volatile today because there is an incredible amount of information to absorb. This information is evolving in almost real-time, driven by the spread of COVID-19, efforts to contain the health crisis, and reactions to the financial crisis. As an important processor of information, I believe the markets will be the first to tell us when matters start to come under control.

If the markets closed down, not only would we lose a most reliable source of information, it would also lead to a number of other issues:

- Investor confidence will plummet because there is not, unlike with 9/11, physical reasons to close the market. Most investors will consider this as an attempt to cover up information.

- Investors will become very concerned that their invested assets can no longer be converted into cash, if and when needed. This could lead to panic and more pressure on the financial system. A run on the banks should not be considered as a ludicrous outcome.

- The wealthiest and best-connected will work out ways to manage their assets. But this option will not be available to everyone else – leading to yet another situation where the “haves” will have a way out and the “have nots” will be stuck.

To put it simply, let’s stop this discussion that is already starting to spook investors, and let’s focus on what matters!

What should I do with my investments?

I am not a financial advisor and will not offer any specific suggestions, but what I have learned over the many years – starting with the 1987 crisis – is that our economies always come back and our markets always come back. In fact, they perform even better than their previous highs. There is a plethora of data confirming this. Why does this happen? Consumers do not disappear, they just pull back. But they will always reemerge. And when they do, they will need more products and services than ever before. And they will need new options. Combine that with the fact that the consumption levels within developing economies is far from being unleashed and you can imagine the growth that is ahead of us.

So, what will I do with my investments? I will stay put and wait where I am currently invested. If I have some cash available, I will put it to work in the undervalued companies and assets out there. If I don’t know which companies to choose, I will go for low volatility/high dividend diversified investment vehicles.

Is there a risk that I stay invested in companies that may go bankrupt? There is always that risk. But our governments have provided clear indications they will not let that happen. Of course, there may be other more fundamental issues with a company, but then the decisions to act should be driven by these other factors.

How long will I sit on my investments? Hard to predict for anyone, but I truly believe that the sooner we flatten the COVID-19 curve, the sooner restrictions will disappear, unlocking our economies and financial markets.

And never forget, in doubt speak to a registered financial advisor!

Should I continue to go hard at my job if I am not sure about the future or my own job security?

My answer? More than ever. The time is now to help our companies overcome the immediate challenges they face. This will ensure they are well positioned to take full advantage when the economies do take off again.

For those who find themselves temporarily out of a job, leverage this time to learn, upskill, and prepare yourselves for the opportunities of tomorrow. Even better, develop new ideas and opportunities and become part of tomorrow’s new entrepreneurs. There is no doubt in my mind that COVID-19 will change certain societal behaviors, think about how it is turning working from home into a much more acceptable concept, and that will lead to new business opportunities.

I can tell you that the team at NEO is working extremely hard because they share in this belief and mentality. I cannot thank each and every member of the NEO team enough for their commitment and hard work, and I know that our collective efforts will pay off.

Expect to see and hear a lot from us in the coming weeks and months, in parallel with our efforts to spread the word and help #FlattenTheCurve!

Stay safe and care for each other.

Jos

Main

Main Mar 25, 2020

Mar 25, 2020